Table of Contents

Ahlstrom-Munksjö has today completed the acquisition of U.S. specialty paper producer Expera Specialty Solutions for an enterprise value of USD 615 million (EUR 526 million) on a cash and debt free basis. The transformative acquisition will expand the company’s presence in North America and further strengthen its offering of advanced custom-made fiber-based materials. The earnings enhancing transaction will almost triple Ahlstrom-Munksjö’s net sales in the U.S. and provide a platform for growth.

- Expera is among the leading specialty paper producers in North America with four paper mills, of which two have integrated pulp production, in the state of Wisconsin, U.S.

- The acquired operations had net sales of USD 721 million (EUR 616 million) and a comparable EBITDA of USD 71 million (EUR 61 million) in 2017.

- Comparable EBITDA includes USD 3 million (EUR 3 million) of items which will not have a continuous impact on EBITDA such as start-up cost of investment and management fees.

- Near term annual synergy benefits of approximately USD 10 million (EUR 8 million) are estimated to be achieved by year end 2019. One-time costs related to the achievement of synergies are estimated at EUR 7 million (USD 8 million). In addition, recently finalized investment offers additional earnings potential of approximately USD 11 million (EUR 9 million) annually when fully commissioned.

- The transaction also enables dynamic synergies relating to product development and best practice sharing.

Hans Sohlström, President and CEO of Ahlstrom-Munksjö, comments: “This acquisition is a major step in the execution of our strategy. It will further strengthen our position in fiber-based materials and enable us to offer more value to our customers, particularly in North America, but also around the world. We have complementary capabilities and can create further value through joint product development and sharing of best practices. Finally, I would like to welcome Expera’s personnel to Ahlstrom-Munksjö. “

The acquisition was announced on July 23, 2018. Customary regulatory approvals have been received for the transaction.

Expera will be consolidated as part of Ahlstrom-Munksjö from October 10, 2018 onwards with more detailed information on the impact of the acquisition to its consolidated accounts in the fourth quarter report. The acquired operations form Ahlstrom-Munksjö’s fifth business area and financial reporting segment, named North America Specialty Solutions. In addition, as described below in more detail, Ahlstrom-Munksjö plans to publish unaudited pro forma financial information at the latest in connection with the rights issue, which is expected to be launched during the fourth quarter of 2018.

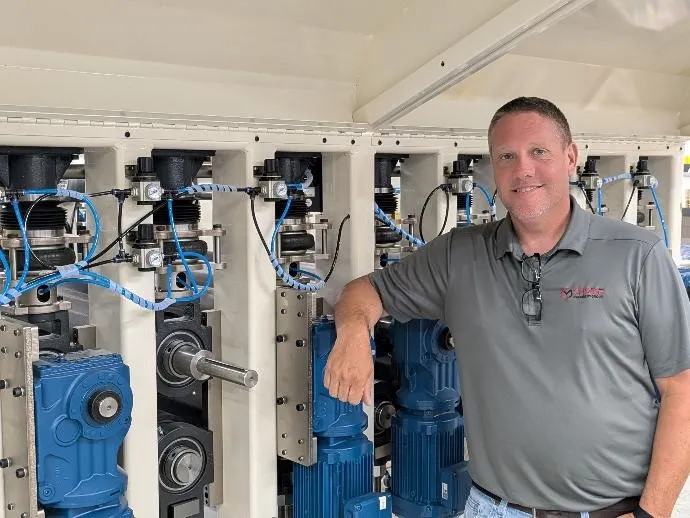

Russ Wanke, the former President and CEO of Expera, has been appointed Executive Vice President, North America Specialty Solutions and a member of Ahlstrom-Munksjö’s Executive Management Team.